UK National Insurance Calculator

NI at 12%: £

NI at 2%: £

Total NI Contributions: £

Annual Take-Home After NI: £

NI Contributions UK Tool – See Exactly Where Your National Insurance Money Goes

I still remember the first time I tried to understand my National Insurance deductions. I stared at my payslip like it was written in code, nodded politely, and moved on. A few years later, curiosity (and a smaller-than-expected take-home pay) pushed me to dig deeper. That’s where the NI contributions UK tool comes in handy.

Short Introduction

This guide explains what the NI contributions UK tool is, how it works, and why it matters for anyone earning or running a business in the UK. If you’ve ever wondered how National Insurance is calculated or whether you’re paying the right amount, this article is for you.

What Is the NI Contributions UK Tool?

The NI Contributions UK Tool is a practical calculator designed to help UK workers, self-employed individuals, and employers estimate their National Insurance (NI) payments accurately.

Think of it as a translator. NI rules can feel like legal jargon wrapped in percentages and thresholds. This tool turns that confusion into clear numbers you can actually use.

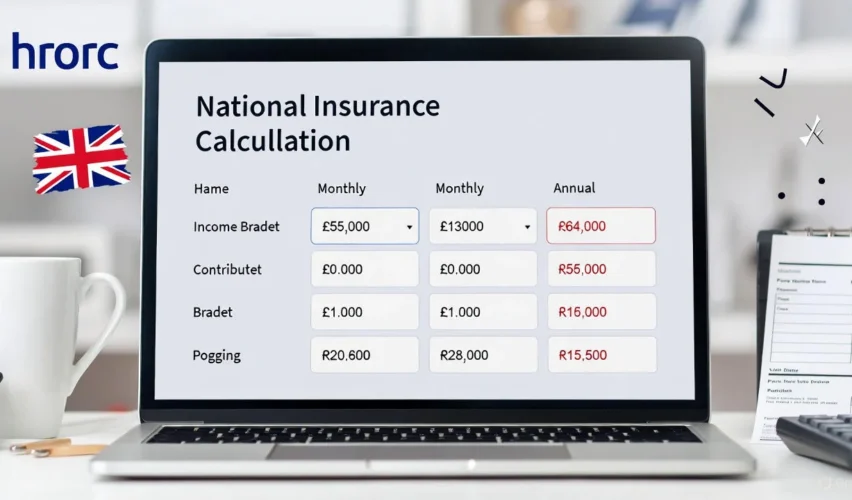

What the Tool Typically Covers

- Enter your income or salary

- Select your employment status (employed, self-employed, director).

- Factor in current NI thresholds and rates

- See weekly, monthly, and annual NI contributions

Instead of guessing, you get a breakdown that mirrors how HMRC calculates NI in real life.

Why Is the NI Contributions UK Tool Important?

Here’s a question worth asking: how can you plan your money if you don’t know where it’s going?

National Insurance affects more than just your payslip. It directly links to:

- State Pension eligibility

- Certain benefits like Maternity Allowance

- Overall take-home pay and cash flow

Using an NI contributions UK tool is like checking a fuel gauge before a long drive. You don’t want surprises halfway through the month.

Real-World Impact

For employees, a small change in salary can shift NI bands.

For freelancers, missing Class 2 or Class 4 NI can create gaps in your record.

For business owners, incorrect estimates can lead to unexpected tax bills.

In short, understanding NI isn’t optional. It’s essential.

How to Use the NI Contributions UK Tool (Step-by-Step)

Using an NI contributions UK tool is refreshingly straightforward. You don’t need an accounting degree.

Step 1: Choose Your Employment Type

- Employed

- Self-employed

- Company director

This matters because NI classes work differently for each group.

Step 2: Enter Your Income Details

- Gross salary or annual profits

- Pay frequency (weekly, monthly, yearly)

The tool uses current NI thresholds to calculate contributions.

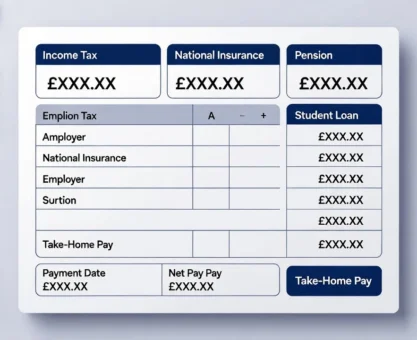

Step 3: Review the Breakdown

- Employee NI contribution

- Employer NI contribution (if applicable)

- Annual total

It’s like seeing your payslip explained in plain English.

Examples and Real-Life Scenarios

Example 1: PAYE Employee

Sarah earns £32,000 a year. After entering her salary into the NI contributions UK tool, she discovers:

- Monthly NI: around £170

- Annual NI: just over £2,000

Seeing the annual figure helps her budget realistically, especially with rising living costs.

Example 2: Self-Employed Designer

Ahmed earns £45,000 in profits. The tool shows:

- Class 2 NI (flat weekly rate)

- Class 4 NI based on profit bands

Without the tool, he might underestimate his liability and struggle at self-assessment time.

Benefits of the NI Contributions UK Tool

The biggest benefit is clarity. But that’s not all.

Key Advantages

- Accuracy: Uses current HMRC thresholds

- Speed: Results in seconds

- Planning: Helps forecast take-home pay

- Confidence: Reduces guesswork

For people already juggling savings, bills, and inflation pressures, tools like this pair well with broader money insights on platforms such as https://ukmoneydaily.com/.

Limitations and Things to Keep in Mind

No tool is perfect, and it’s fair to be realistic.

What the Tool Can’t Do

- Replace professional tax advice for complex cases

- Account for historic NI gaps automatically

- Handle unusual income types without manual adjustments

Think of it as a reliable satnav, not a driving instructor. It shows the route, but you’re still in control.

NI Contributions and Wider Money Planning

Understanding NI is one piece of the financial puzzle. Many UK households are reassessing their finances due to economic shifts and tax changes.

You may also find these related reads useful:

- https://ukmoneydaily.com/uk-households-brace-for-income-tax-rise-before-2025-budget/

- https://ukmoneydaily.com/autumn-budget-2025-uk-tax-rises-how-to-prepare/

- https://ukmoneydaily.com/why-uk-savers-are-losing-out-inflation-vs-savings-rates/

They connect the dots between NI, income tax, and real-world spending power.

FAQs About NI Contributions UK Tool

Does the NI Contributions UK Tool replace HMRC calculators?

No. It complements them by offering a simpler, more user-friendly estimate, but HMRC tools remain the official reference.

Is the tool suitable for company directors?

Yes, many versions allow director-specific calculations, which use annual earnings periods rather than weekly ones.

Can it help with budgeting?

Absolutely. Seeing NI monthly and annually makes planning far easier.

Is my data stored?

Most online tools don’t store personal data, but always check the site’s privacy policy.

Protection Tips When Using Online Financial Tools

- Avoid entering personal identifiers like NI numbers.

- Stick to trusted UK finance sites

- Be cautious of copycat or scam websites

For broader awareness, this guide is worth reading: https://ukmoneydaily.com/how-to-spot-fake-delivery-texts-qr-code-scams-uk/

External Resources

These pair well with an NI contributions UK tool for deeper understanding.

Conclusion

National Insurance doesn’t have to feel mysterious or intimidating. The NI contributions UK tool turns a confusing deduction into something you can see, understand, and plan around. Once you know the numbers, better decisions follow naturally.

If you want clearer insight into your money and how UK taxes really work, start using tools like this regularly and explore more practical guides at https://ukmoneydaily.com/.

Call to Action

Try an NI contributions UK tool today, check your estimates, and take five minutes to understand what your payslip has been trying to tell you all along.