UK Tax Breakdown Tool

Income Tax: £

National Insurance: £

Total Tax: £

Take Home Pay: £

Tax Breakdown UK Tool: See Exactly Where Your Money Really Goes

I still remember the first time I opened my payslip properly. Not the quick glance at the take-home pay, but the deep stare. Income tax. National Insurance. Pension. Student loan. It felt like watching a pizza arrive at the table already missing half the slices. That moment is exactly why the Tax Breakdown UK Tool exists.

Introduction

This article explains what a Tax Breakdown UK Tool is, how it works, and why it’s genuinely useful for anyone earning or planning money in the UK. If you’ve ever wondered where your salary disappears to each month, this guide will finally make things click.

What Is a UK Tax Breakdown Tool?

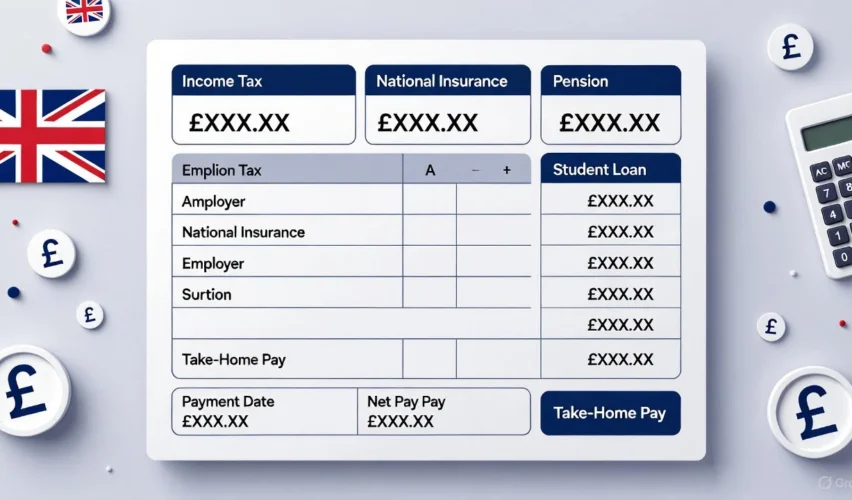

A Tax Breakdown UK Tool is a calculator that shows how your gross income is divided across different UK taxes and deductions. Instead of one confusing net figure, you see each slice clearly laid out.

Think of it like an itemized receipt for your salary.

Most tools break income into:

- Income Tax (based on tax bands)

- National Insurance contributions

- Student loan repayments

- Pension deductions

- Take-home pay

From a user’s perspective, I act as the translator between HMRC’s rules and everyday life. No jargon. No head-scratching.

What It’s Not

- It’s not an HMRC filing system.

- It doesn’t replace an accountant.

- It won’t magically lower your tax bill.

But it will help you understand it.

Why Is the Tax Breakdown UK Tool Important?

Here’s a question worth asking: how can you plan your finances if you don’t know what’s actually happening to your income?

A UK tax breakdown tool matters because:

- UK tax rules change often.

- Payslips hide complexity behind small labels

- Budget announcements affect real take-home pay.

With rising discussions around income tax thresholds and future budgets, like those covered in the Autumn Budget analysis on UKMoneyDaily, clarity isn’t optional anymore.

Understanding your tax breakdown helps you:

- Budget realistically

- Spot errors early

- Plan savings and investments

- Avoid nasty surprises at year-end

It’s the difference between driving with a fogged-up windscreen and a clear one.

How to Use the Tax Breakdown UK Tool (Step-by-Step Guide)

Using a UK tax breakdown tool is refreshingly simple. No forms. No waiting.

Step 1: Enter Your Gross Income

This is your salary before deductions. Annual or monthly, depending on the tool.

Step 2: Select Your Details

You may need to choose:

- Employment type

- Pension contribution percentage

- Student loan plan (Plan 1, Plan 2, Postgraduate)

Step 3: Review the Breakdown

You’ll instantly see:

- Income tax per band

- National Insurance contributions

- Total deductions

- Net take-home pay

Step 4: Adjust and Compare

Change numbers and see the impact. It’s surprisingly eye-opening.

Real-Life Scenarios and Examples

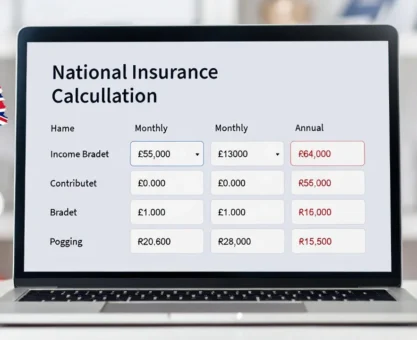

Example 1: PAYE Employee on £35,000

Using the Tax Breakdown UK Tool, you’ll see:

- Personal allowance applied

- Basic rate tax on remaining income

- Class 1 National Insurance deductions

Many users are shocked to learn how much National Insurance quietly adds up over a year.

Example 2: Graduate With Student Loan

Add a Plan 2 loan, and suddenly:

- Repayments kick in after the threshold

- Monthly take-home drops more than expected

This ties closely with wider concerns about UK household finances, often discussed on UKMoneyDaily.

Example 3: Salary Increase That Feels Small

Ever had a pay raise that didn’t feel like one?

A UK tax breakdown tool shows how crossing a tax threshold can flatten gains.

Benefits of the Tax Breakdown UK Tool

The biggest benefit is confidence. Once you understand your numbers, money decisions feel calmer.

Key advantages include:

- Clear visibility of all deductions

- Better salary negotiations

- Improved budgeting accuracy

- Smarter tax-aware planning

- Reduced anxiety around HMRC letters

With HMRC increasingly using digital prompts, like the crypto tax nudge letters discussed here, awareness is power.

Limitations and Things to Keep in Mind

No tool is perfect, and honesty matters.

A UK Tax Breakdown Tool:

- Uses standard tax assumptions

- May not reflect complex tax codes

- Doesn’t cover self-assessment nuances

- Can’t replace professional advice for unusual income

If you’re self-employed, have multiple income streams, or deal with property or crypto taxes, extra care is needed.

Use the tool as a guide, not gospel.

FAQs About the Tax Breakdown UK Tool

Is the Tax Breakdown UK Tool accurate?

It’s accurate based on current UK tax bands and standard assumptions, but always check your payslip or HMRC account.

Can it help me save on tax?

Indirectly, yes. Understanding deductions helps you plan pensions, allowances, and savings more effectively.

Does it work for self-employed users?

Some tools do, but many are PAYE-focused. Always check the scope.

Is my data safe?

Reputable tools don’t store personal information. Avoid calculators asking for unnecessary details.

How often should I use it?

Any time your income changes, or after budget announcements.

Protection Tips When Using Online Tax Tools

Not all calculators are built with users in mind. Stick to trusted platforms.

Keep these tips in mind:

- Avoid tools asking for NI numbers.

- Don’t upload payslips unnecessarily.

- Use HTTPS-secured websites

- Cross-check results occasionally

UKMoneyDaily regularly covers digital safety issues, including scam awareness and financial protection.

Related Topics Worth Reading

- Income tax rises before the 2025 budget

- Why UK savers are losing out to inflation

- How AI tools are changing money management

You’ll find practical insights across the UKMoneyDaily platform that complement a Tax Breakdown UK tool perfectly.

External References

- HMRC Income Tax Rates and Allowances

- National Insurance Contribution thresholds

- UK Government Budget documents

These sources provide the raw rules that tools interpret.

Conclusion

A Tax Breakdown UK tool doesn’t just crunch numbers. It tells a story about your income. One that’s usually hidden behind acronyms and deductions.

Once you see that story clearly, you stop guessing and start planning. And that’s where better financial decisions begin.

Call to Action

If you want clearer money decisions, start with clarity.

Explore practical tools, insights, and UK-focused guidance at https://ukmoneydaily.com/ and take control of your financial picture today.